are inherited annuity distributions taxable

Unfortunately gains are distributed first. An annuity normally includes both gains and non-taxable principal.

Annuity Exclusion Ratio What It Is And How It Works

If youre younger than 59 ½ and anticipate.

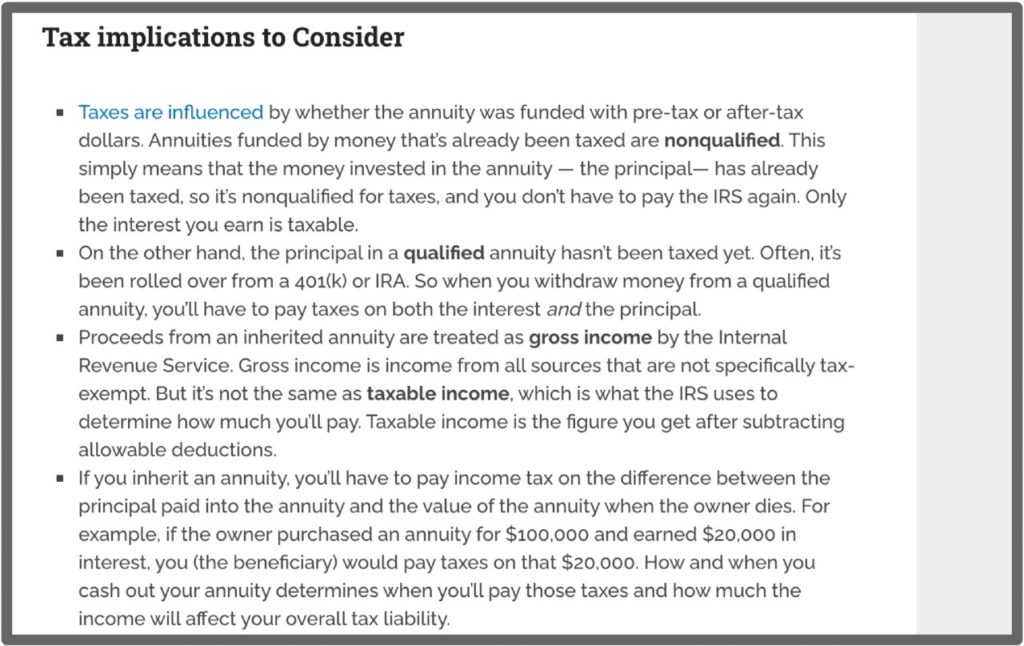

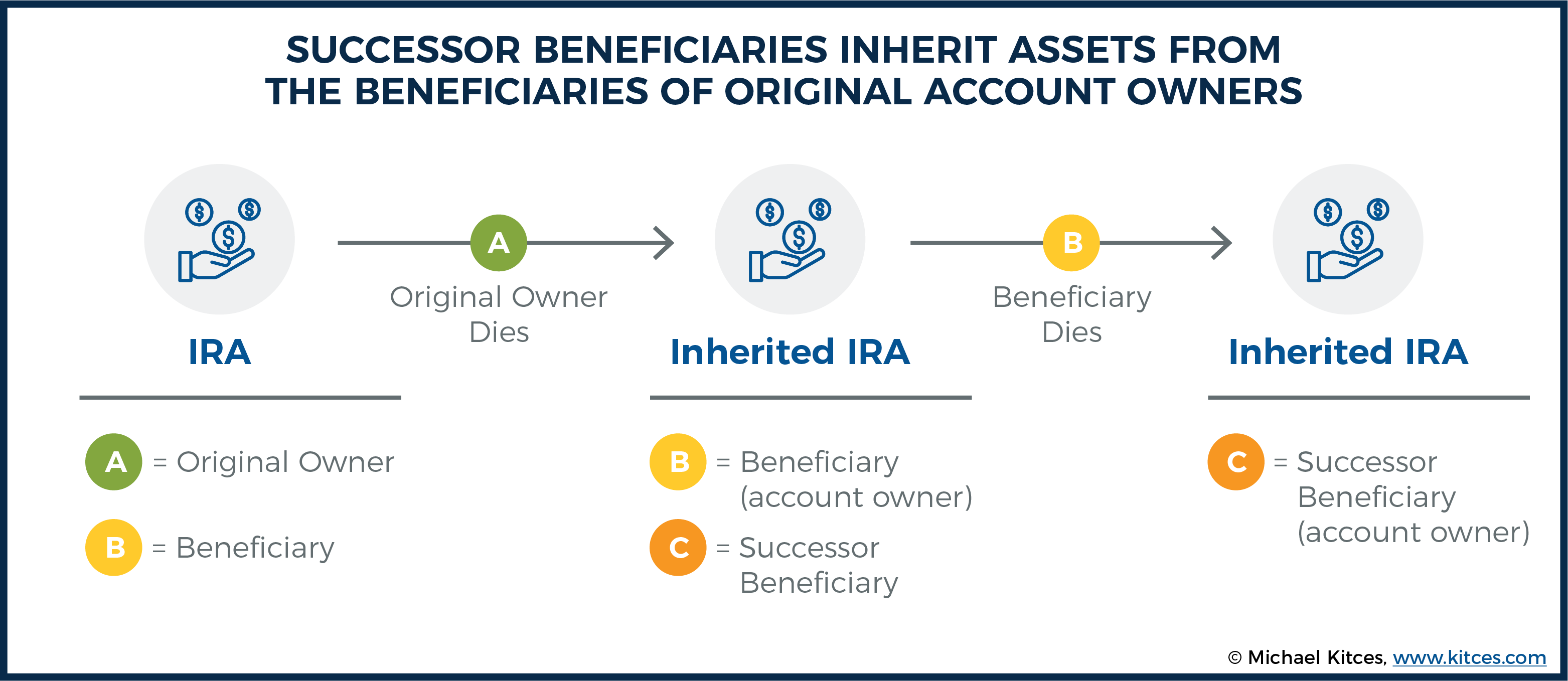

. A beneficiary can be any person or entity the owner chooses to receive the benefits of a retirement account or an IRA after he or she dies. The IRS has resolved a dispute over new rules for inherited IRAs by punting enforcement of new. Inherited Annuity Tax Implications Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account.

If you are the beneficiary and inherit an annuity the same tax rules apply. The original contributions ie the principle wont be subject to any taxes. Most beneficiaries that choose not to immediately withdraw the death benefit in a lump sum will.

If you keep the annuity you will usually have. What youll pay in taxes for an inherited annuity can depend on whether the annuity is qualified or non-qualified. But even a series of five equal distributions has tax drawbacks.

Beneficiaries of a retirement account or. You started taking required minimum distributions from the inherited IRA in 2019 when you were age 55 using a life expectancy of 296 and reducing that number by 1 each year so that in 2022. Like any other type of income inherited annuities are taxable.

If the annuity owner still had ownership when he died the value of the annuity is included in his. Federal tax law only imposes an estate tax on wealth passed down at death. If you inherited an annuity as a listed beneficiary on the policy you have a few distribution options.

The bait and switch. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. Qualified annuity distributions are fully taxable.

If you cash out an inherited annuity you may have to pay taxes on the money you receive. Qualified annuities are funded with pre-tax dollars. Below are the primary choices that you have.

Inherited annuities are taxable as income. If you elect nonperiodic distributions however the IRS typically treats distributions as taxable earnings until theyre used up after which further payouts are treated as return of the. Inherited annuities are taxable as income.

If you have inherited your spouses annuity you can choose to transfer the annuity contract into your name. Lump-sum distributions withdrawals from. Taxes may be guaranteed but that doesnt mean theyre easy to understand.

The earnings are taxable over the life of the payments. No one likes paying taxes to Uncle Sam and a mere 17 of American households led by someone between 40 and 85 owns an. Payouts of inherited annuities must follow certain distribution rules.

Much like taxes annuities just arent very popular. Taxation of distributions from qualified plans and 403b annuities is complex and. You can choose a lump sum.

The beneficiary of a tax-deferred annuity may choose from several payout options which will determine how the income benefit will be taxed. When you inherit an annuity the tax rules are similar to everything described above. If you dont this will be treated as a fully taxable distribution just like any other fund from a non-qualified annuity.

Doing so allows you to keep the same options as the original owner. If payments are tax-deferred any gains in interest dividends or capital gains stay untouched until withdrawn. You may also have to pay fees to cash out the annuity.

Are inherited annuity distributions taxable. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded. If the heir decides instead to continue getting the periodic annuity payments shell pay tax on each.

Annuity Beneficiaries Inheriting An Annuity After Death

Does The Inheritance Of An Annuity Affect Social Security Payments

Inheritance Annuities Know Your Annuity Contract Transamerica

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Tax Rules For An Inherited Nonqualified Annuity

Inherited Annuity Tax Guide For Beneficiaries

What Is A Tax Deferred Annuity Due

Successor Beneficiary Rmds After Inherited Ira Beneficiary Passes

Are Inherited Annuities Exempt From Federal State Taxes

Understanding Annuities And Taxes Mistakes People Make Due

Inherited Annuities What Are My Options 2022

Inherited Annuity Tax Guide For Beneficiaries

Is Annuity Inheritance Taxable

Taxes And Your Inherited Annuity Annuity Fyi

How Does Inheriting An Annuity Work Smartasset

What Is The Best Thing To Do With An Inherited Annuity Due