vermont state tax rate 2021

The Vermont Department of Taxes publishes a report after each legislative session that outlines how legislation impacts taxpayers. PA-1 Special Power of Attorney.

State Income Tax Rates Highest Lowest 2021 Changes

80024 2312 Rev.

. I file a tax return in Name of state Check and complete one box below Withhold Withhold Do not withhold. We can also see the progressive nature of Georgia state income tax rates from the lowest GA tax rate bracket of 1 to the. Oklahoma Tax Brackets 2020 - 2021.

Read the 2022 report. Looking at the tax rate and tax brackets shown in the tables above for Oklahoma we can see that Oklahoma collects individual income taxes differently for Single versus Married filing statuses for example. 2020 VT Rate Schedules.

Read the 2022 legislative highlights to find out whats changed. VERMONT Withhold 30 regardless of my federal election. We can also see the progressive nature of Oklahoma state income tax rates from the lowest OK tax rate bracket of.

Looking at the tax rate and tax brackets shown in the tables above for Georgia we can see that Georgia collects individual income taxes differently for Single versus Married filing statuses for example. W-4VT Employees Withholding Allowance Certificate. Flat rate applies to all incomes.

These rates can be substantial so a state with a moderate statewide sales tax rate could actually have a very high combined state and local rate compared to other states. 112021 2021 Ascensus LLC STATE. IN-111 Vermont Income Tax Return.

In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget. Before sharing sensitive information make sure youre on a state government site. The previous 882 rate was increased to three graduated rates of 965 103 and 109.

State government websites often end in gov or mil. 2020 VT Tax Tables. 112021 2021 Ascensus LLC OTHER Use this section to elect a withholding rate not listed on page 1.

Georgia Tax Brackets 2020 - 2021. State 2021 Flat Tax Rate. Currently 16 states Alaska Arizona California Colorado Illinois Maine Massachusetts Michigan Montana Nevada New Jersey New York Oregon South Dakota Vermont and Washington and the District of Columbia have passed bills or approved ballot.

The legalization and taxation of recreational marijuana remains one of the hottest trends in state taxation. 2021 Income Tax Withholding. All these rates apply to incomes over 2 million with the highest rate of.

This report provides a population-weighted average of local sales taxes as of January 1 2022 to give a sense of the average local rate for each state.

Spirit Level Psychiatry Economics Spirit

Pin By Eris Discordia On Economics Capital Market Chart Giant Market

Pin By Eris Discordia On Economics Capital Market Chart Giant Market

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Bank Of America Near Me Find Branch Locations And Atms Nearby Bank Of America America Bank

Vermont Income Tax Calculator Smartasset

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

These States Have The Highest And Lowest Tax Burdens

What Is The Most Valuable Fruit Crop Produced In The Peach State This Is Not A Trick Question But You May Want To Pause A Second Be Georgia Orange Fruit Peach

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset

More Than 1 In 8 Oklahoma Children Live In A Home Where The Head Of The Household Doesn T Have A High S Counting For Kids Education Issues Health Care Coverage

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

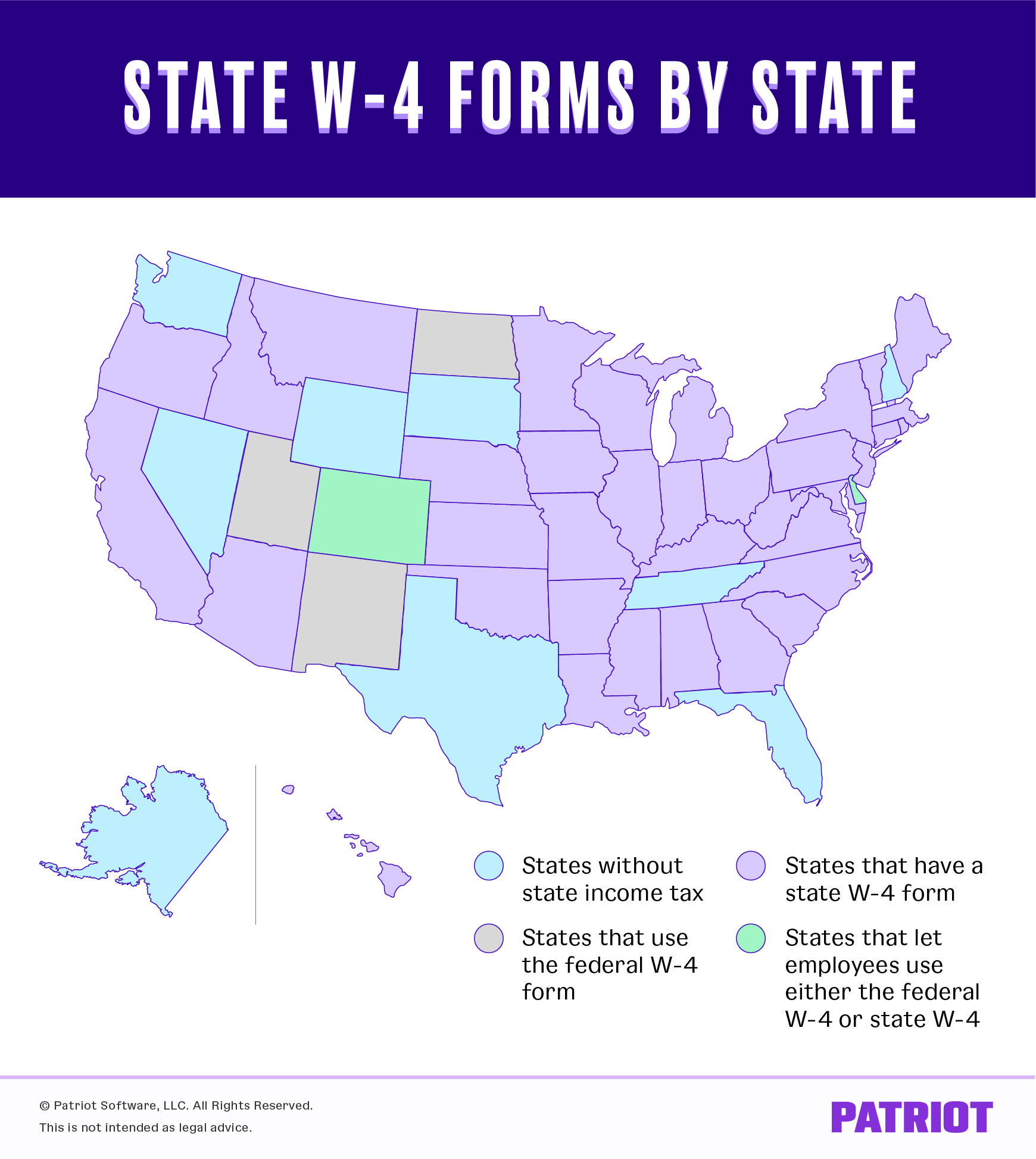

State W 4 Form Detailed Withholding Forms By State Chart

Spirit Level Psychiatry Economics Spirit

10 States With No Property Tax In 2020 Property Tax Property Investment Property

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)